td ameritrade tax rate

As of 2020 the tax rates for long-term gains rates range from zero to 20 for long-term held assets depending on your taxable income rate. 2 You will be taxed only upon sale.

Td Ameritrade Fees Personal Experience R Phinvest

Where can I find my TD tax document.

. 2022 TD Ameritrade fees schedule commissions broker stock trading cost charges online investing account pricing cash sweep rates. 3 Short-term capital gains apply when held less than one year. Depending on your activity and portfolio you may get your form earlier.

Futures Options on Futures. Option fees are waived when you buy to close any short individual or single leg option for USD005 or less. All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099.

Treaty claims are made through the IRS Form W-8BEN. The statutory rate is 30 unless you have claimed an active treaty for your account in which case it may be lower. TD Ameritrade Review 2022.

All Promotional items and cash received during the calendar year will be included on your consolidated Form 1099. Interest income on Municipal Bonds may be subject to the Alternative Minimum Tax. Discount bonds may be subject to capital gains tax.

Unsupported Chrome browser alert. I was wondering is this the tax rate of 22 or is there something else happening. However I only received 978 in my actual balance.

6000 into a separate IRA Earnings. The marginal tax rates in 2017 before the tax reform were 10 15 25 28 33 35 and 396. We suggest you consult with a tax-planning professional with regard to your personal circumstances.

Is required by federal andor state statutes to withhold a percentage of your IRA distribution for income tax purposes. 5 There are typically no dividends or interest income. TD Ameritrade does not provide tax advice.

Exchange and Regulatory Fees Exchange fees vary by exchange and by product. TD Ameritrade does not provide tax advice. Federal and state income tax rates can change without prior notification.

225 fee per contract plus exchange regulatory fees Youll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account including energy gold and other metals interest rates stock indexes grains livestock and more. Form 1099 OID - Original Issue Discount. TD Ameritrade is tough to beat with its 0 minimum free tools and research and multiple trading platforms aimed at.

If you do not make an election we will automatically apply withholding if required at the maximum rate based on your state of residency. As of July 29 2022 the current base rate is 1050. Subject to change without prior.

Ordinary dividends of 10 or more from US. -You are age 59 12 or older. Taxes related to TD Ameritrade offers are your responsibility.

For the present long-term capital gains taxes do not exceed 238 including the 38 NIIT. When setting base rates TD Ameritrade considers indicators like commercially recognized interest rates industry conditions related to credit the availability of liquidity in the marketplace and general market conditions. My bank also charged me with international wire fees outside of the original 1000.

For more information on tax treaties for international investors please visit the IRS site for Tax Treaty Tables. And foreign corporations capital gains distributions mutual fund dividends federal and foreign tax withheld and non-taxable distributions. 010 of the total transaction cost of in scope equities and other financial instruments and a flat amount which ranges from EUR0 025 to EUR 200 depending on the relevant instruments and on its notional value for derivatives traded on a regulated market or multilateral trading facility in a EU Member State.

Futures Futures Options USD241 per contract plus exchange regulatory fees. - The Roth IRA account has been open for at least 5 years. USD070 per contract with no ticket charge exercise or assignment fees.

Up to age 50. How much do you get taxed on TD Ameritrade. In other cases TD Ameritrade Clearing Inc.

4 Long-term capital gains rates apply when held more than a year. TD Ameritrade does not provide tax advice. Tax Rate - Ticker Tape.

Pros Cons and How It Compares. Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of. With the exception of the 10 and 35 brackets the current tax rates are lower across the board.

Free from federal income tax when. Mailing date for Forms 4806A and 4806B. To log in upgrade to the latest version of Chrome or use a.

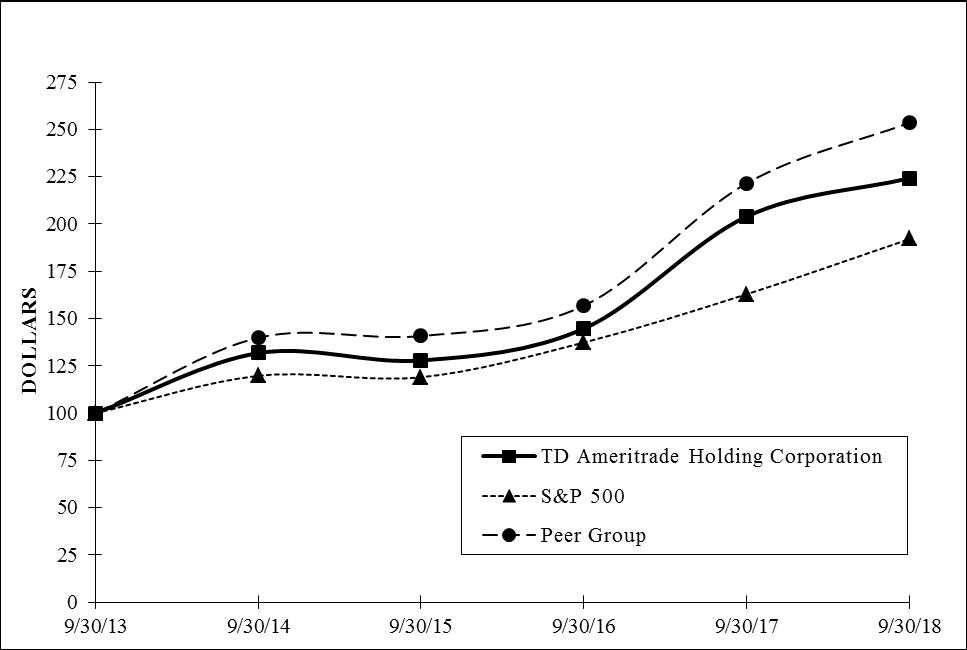

TD Ameritrade Holding Tax Rate as of today January 17 2022 is 2444. See all contact numbers. TD Ameritrade will report a dividend as.

Hi I live abroad and I recently wire transfered 1000 from an international bank account to my TD ameritrade account. Although the number of marginal tax rates stayed the same after the tax reform bill passed the rates were different. Get in touch Call or visit a branch Call us.

Please consult a tax advisor regarding your personal situation. The Plus IDA is a program for TD Ameritrade clients with 1 million or more in assets.

Td Ameritrade Review 2022 Day Trading With 0 Commissions

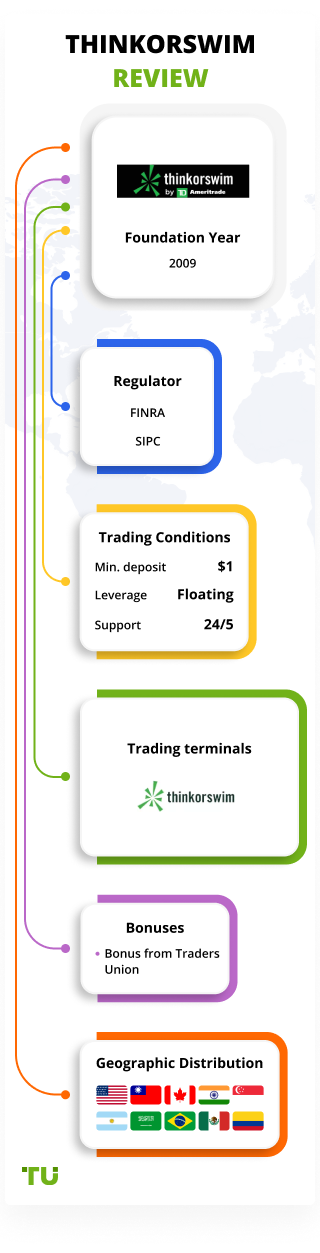

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

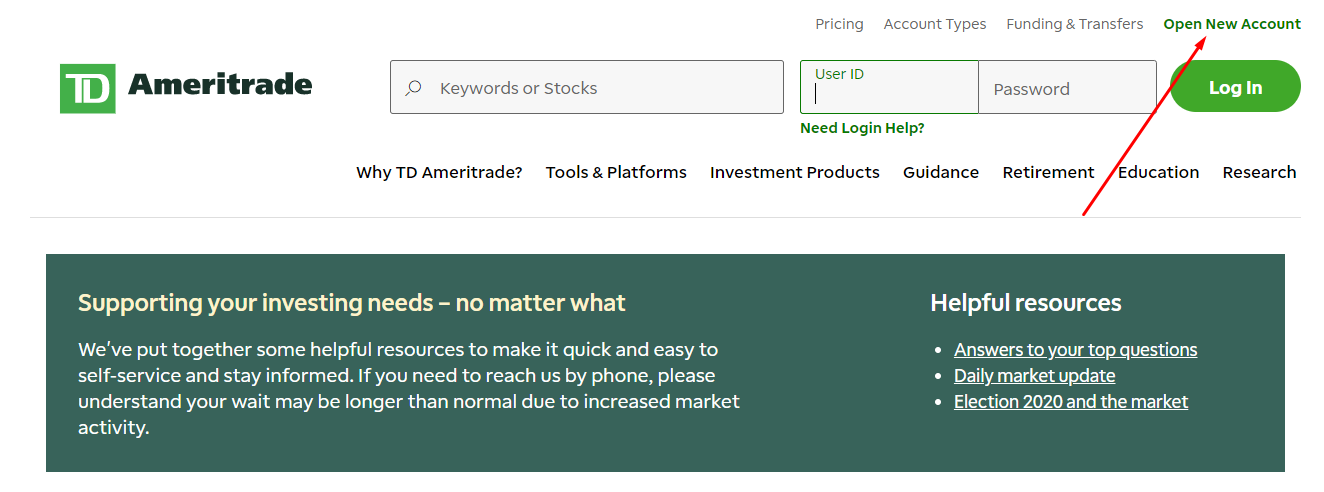

I Opened A Td Ameritrade Account Now What Katie Scarlett Needs Money

Td Ameritrade Review 2022 Pros Cons And How It Compares Nerdwallet

Td Ameritrade Review 2022 Pros And Cons Uncovered

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

Non Usa Persons With A Usa Brokerage Account Do I Owe Tax

Td Ameritrade Review 2022 Pros Cons And How It Compares Nerdwallet

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

Mr Rjb Jr S Td Ameritrade Statements March 2015 06 18 2015

How Do Tax Brackets Actually Work Youtube

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

Thinkorswim By Td Ameritrade Review 2022 Pros And Cons

How To Open A Td Ameritrade Account Outside Of The Us As A Non Resident Alien Katie Scarlett Needs Money

I Opened A Td Ameritrade Account Now What Katie Scarlett Needs Money

Td Ameritrade Thinkorswim Review A Comprehensive Write Up On This Zero Cost Brokerage Firm New Academy Of Finance